Are You Prepared For The World To Still Be Here?

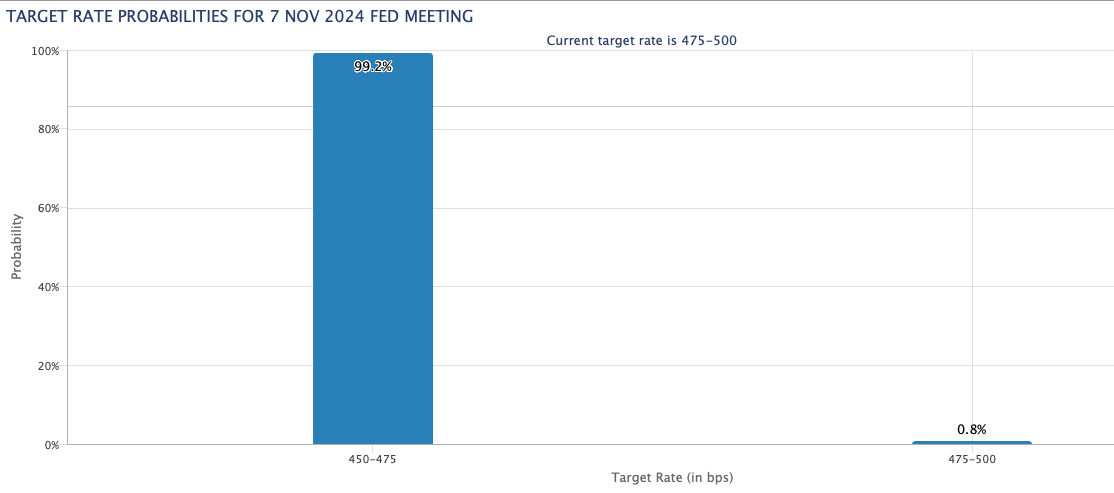

According to the CME FedWatch tool, there is a 99.2% that the Fed will lower the target rate today by 0.25%.

I’m with the Austrian economists rather than the Keynesian economists. In short, that means I believe the Fed creates the boom/bust cycle when it raises and lowers the target rates. As opposed to the Keynesians who believe that the Fed softens the boom/bust cycle when it changes the target rates.

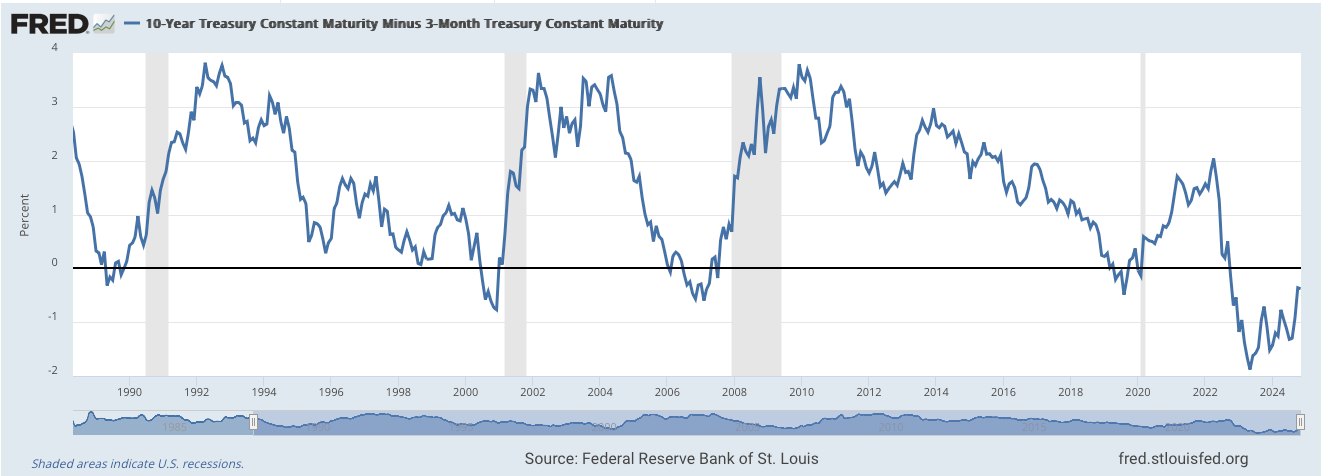

The best measure of the boom/bust cycle is the inverted yield curve, specifically the 10 year minus 3 month. What’s an inverted yield curve? Normally, we’d assume the longer one is willing to invest their money, the higher their return. If I invest for 10 years, I should get a higher return than if I only invested for 3 months.

For example, on April 15th, 2022, the 10 year treasury would’ve returned me 2.83%. The 3 month treasury would’ve returned me 0.79%. The 10 year was greater than the 3 month, and the 10 year minus 3 month would be 2.04% (2.83% - 0.79% = 2.04%), and that’s a positive number. Fast forward to October 31st, 2022, the 10 year treasury would’ve returned 4.1%. The 3 month treasury would’ve returned 4.22%. The 10 year is less than the 3 month, and the 10 year minus 3 month would be -0.12% (4.1% - 4.22% = -0.12%), and that’s a negative number. That negative number means the yield curve has inverted.

The 10 year minus 3 month has been inverted since October 2022. That is the longest that curve has ever been inverted.

Since the Fed lowered rates in September, the 10 year minus 3 month has been heading toward uninverting. Historically, a recession doesn’t hit when the yield curve inverts—it hits when the yield curve uninverts. (Shaded areas in the graph below are recessions, and the line dropping below 0% indicates an inversion.)

The Fed changing the target rate more drastically affects the short term treasuries. In other words, if the Fed lowers the target rate today, the short term 3 month treasury will likely follow suit and drop as well. If the 3 month goes down, that gives more fuel for the yield curve to uninvert. And that indicates a coming recession.

Why tell you all this? Because some people see stuff like this and they start preparing for the world to end. They might not bury their talent in the ground, but they definitely bury it in a bomb shelter.

Instead, prepare for opportunity. Prepare to take action. Prepare to grow your community ties. Depend on more loved ones, and make sure your loved ones can depend on you. Because rugged-prepping individualists get picked off.

Maybe some of you are prepared for the world to end—but are you prepared for the world to still be here?

What do you think?

Joseph