Calculating Interest 4: Internal Rate of Return (IRR)

Compound Interest may be the holy grail of investing, but it doesn’t capture cash flow. Instead, compound interest only measures the appreciation of your investment.

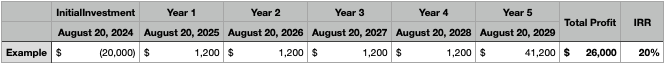

Internal Rate of Return (IRR) captures both cash flow and appreciation. For example, you invest $20K into a cash flowing asset. In Year 1, you make $1,200 in total cash flow ($100 per month). In Year 2, you make $1,200. And so on in Year 3, Year 4, and Year 5. By the end of Year 5, your asset has appreciated in value, so you sell the asset and end up with $40K in your pocket. Over the 5 years, you invested $20K and you received a total of $46K ($1,200 x 5 years + the $40K profit at the sale). Your total profit is $26K ($46K - $20K). And your IRR is 20%.

Simple interest can give you an idea of the cash flow, and compound interest can help you calculate the appreciate; but IRR does both.

IRR is handy, but it has two drawbacks. The first is that it’s complicated math. You need to use Excel, Numbers, or Google Sheets to figure it out.

And the second is you can break IRR so it gives you weird results. IRR assumes you will immediately put any cash flow you receive into another high return investment, instead of just parking your cash into a checking account. Take a look at this.

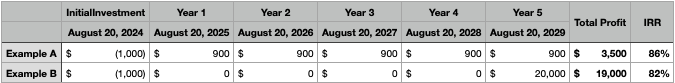

In both examples, you start by investing $1K. In Example A, you get $900 per year for 5 years and then the investment ends. Your total profit is $3,500 ($900 x 5 years minus the initial $1K). And your IRR is 86%. Not bad, right?

In Example B, you don’t get any return at all until Year 5, and then you get a whopping $20K. Your total profit is $19K ($20K minus the initial $1K). And your IRR is 82%.

Wait a second! Example A gets you 86% IRR, but it only puts $3,500 in your pocket. Example B gets you 82% IRR (4% less than Example A) and you walk away with more than 5 times the amount of money.

Again, the reason IRR breaks down in scenarios like this is because it assumes you will immediately reinvest that $900 cash flow into another high return investment.

Overall, IRR is useful. But never lose yourself in the math. Step back and take a look at how much money you’ll have at the end of the day. Focus more on the volume of capital returned to you, rather than just the interest rate.

What do you think?

Joseph

This is a series. Here is the previous post. Here is the next post.